Automotive wiring harnesses and connectors are critical components in the electronics and electrical architecture of a vehicle. With the trends of automotive electrification, automation, and connectivity, as well as the upgrade of E/E architectures, the industry is experiencing development opportunities. This report details the new application areas for automotive wiring harnesses and connectors driven by the trend of electrification and intelligentization, and estimates the market space for the industry.

Wiring harnesses and connectors are the veins and nerves of electronic systems, widely used in various parts of a car

Wiring harnesses

Automotive wiring harnesses are the primary network for automotive electronic circuits, acting as the veins and nerves of an automotive electronic system. A wiring harness is a component that is formed by crimping connectors and electrical wires/cables, then bundling them with plastic insulators or metal casings to form connected circuits. Its basic function is to ensure reliable electrical connections for electronic components over their service life. Wiring harnesses connect various electronic components, ECUs, sensors, actuators, and other electronic and electrical devices in the car, transmitting power and signals to different parts of the vehicle.

There are many types of custom automotive wiring harness, categorized by transmission function, voltage range, application position, and other criteria.

By transmission function, they can be divided into power lines and signal lines. Power lines use thick wires, while signal lines are multi-core soft copper wires with better shielding.

By voltage range, they can be classified as high-voltage harnesses and low-voltage harnesses. High-voltage harnesses operate above 60V and have superior temperature resistance, pressure resistance, and electromagnetic interference resistance compared to low-voltage harnesses.

By application location in the vehicle, they can be divided into engine compartment, cabin, chassis, etc. For new energy vehicles, additional harnesses for the three-electric system and high-voltage accessories are included.

In terms of market scale, with the ongoing penetration of electrification and smart technologies in the global automotive market, the market for automotive high-voltage and high-speed wiring harnesses is expected to grow continuously. It is anticipated that by 2030, the global automotive wiring harness market will exceed 448.4 billion yuan, with a CAGR of 1.0%/14.1%/25.3% from 2023 to 2030 for standard low-voltage harnesses/high-voltage harnesses/high-speed harnesses, respectively.

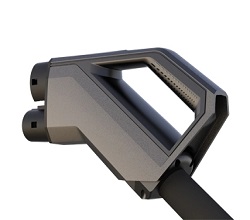

EV Connectors

Connectors are located at the ends of wiring harnesses and are essential components for connecting the harnesses to electrical devices. Also known as plugs, plug-ins, or sockets, connectors, either independently or together with cables, transmit electrical current or optical signals between devices, components, equipment, or subsystems, and are indispensable parts of a wiring harness system. The basic structure of connectors includes contacts, insulators, shells, and accessories, with the contact (terminal) being the core of a connector.

Automotive is a major downstream application market for connectors, with key performance indicators being mechanical properties like longevity and impact resistance, as well as electrical characteristics like high voltage and interference resistance. The applications of China car connector span the entire electronic industry, including automotive, communications, computers, industrial, and transportation sectors. Among these, communications (23.47%) and automotive (21.86%) were the largest application areas in 2021 (Bishop&Associate). Depending on the application scenario, the functional characteristics and technical focus of connectors differ, with high-voltage, high-current capabilities, mechanical longevity, and impact resistance being critical indicators in the automotive industry.

North America is expected to be the main growth market for electric vehicle connectors during the forecast period

The global EV charging connectors market is expected to grow from USD 2 billion in 2023 to USD 10.9 billion by 2030, at a CAGR of 27.1%.

North America is a hub for many well-known original equipment manufacturers (OEMs) that provide high-performance vehicles. In North America, OEMs like Tesla and General Motors are focusing on developing cleaner, faster, and high-performance electric vehicles. Various services offered by electric vehicle infrastructure providers have increased the adoption rate of electric vehicles in the U.S. Tesla, Ford Motor Company, and General Motors have included some ADAS features as standard in their electric vehicles. Due to the increase in electric vehicle sales and connected applications, including autonomous driving, connected services, ADAS, high-end infotainment systems, and powertrain solutions, the North American EV connectors market is expected to grow significantly. As technology becomes more prevalent and prices decrease, more consumers in the region are purchasing vehicles equipped with ADAS features. This has led to increased demand for these systems and subsequently a rise in the number of electric vehicles equipped with ADAS. Therefore, the demand for electric vehicle connectors is also expected to increase with the growth in electric vehicle sales and the enhanced adaptation of ADAS, high-end infotainment systems, and powertrain solutions.

English

English  日本語

日本語  Deutsch

Deutsch  ไทย

ไทย  русский

русский  العربية

العربية